New Idaho officials talk taxes, upcoming legislative session

Concerns about the economy, budget outlooks, property taxes and other subjects were the focus of the 76th annual Associated Taxpayers of Idaho Conference on Wednesday, with legislators and newly elected officials in attendance about a month before the next legislative session begins.

The Associated Taxpayers of Idaho is a nonprofit organization that produces reports related to state and local tax policy and distributes them to members. Incoming Lt. Gov. Scott Bedke, who is the speaker of the Idaho House of Representatives until January, gave opening remarks at the conference and said he is constantly asked what the 2023 legislative session will be like with so many freshman legislators.

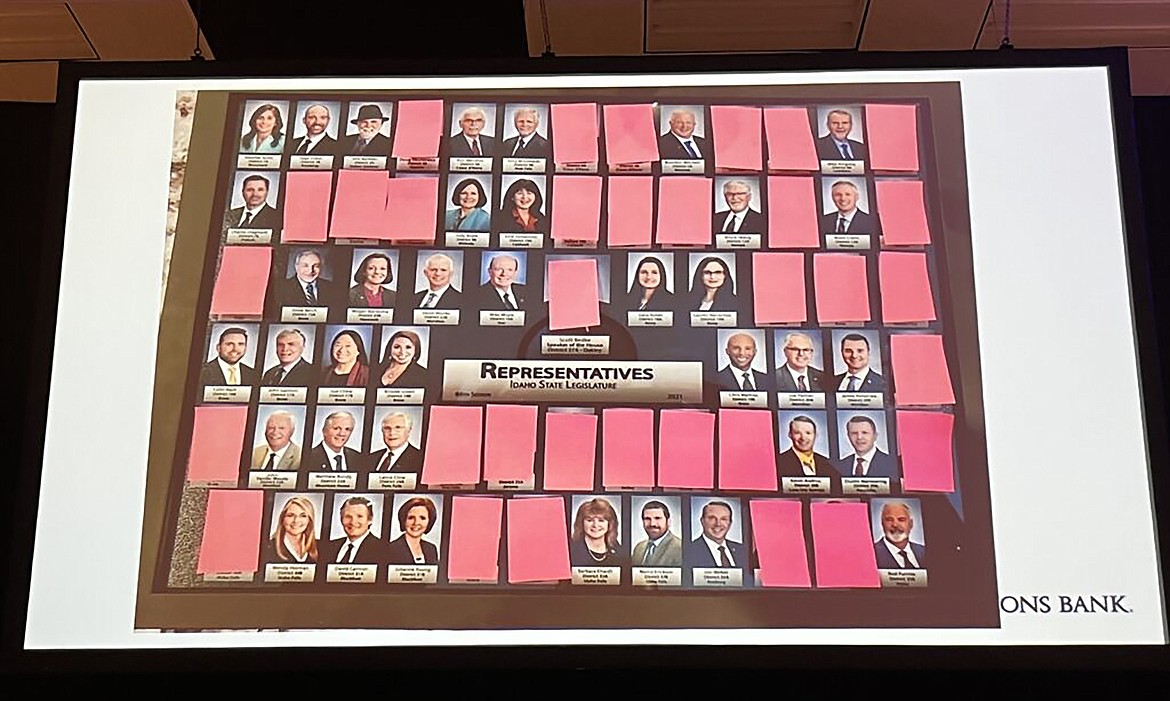

Bedke showed a visual of just how many legislators won’t be coming back in January in the House alone, with about half of the portraits of the previous Legislature covered by pink pieces of paper. He likened it to a “potato college” in Bingham County where he recently spoke and listened to research scientists describe the specific details of issues related to the industry in terms that only people who had been doing that work would understand. If half of them were suddenly replaced with new people, regardless of how passionate they were, it would take a while for them to understand the nuances of the industry.

“These are people that live in Idaho, they’re pro-Idaho and pro-potato, but they don’t know what they don’t know, and they’ve got to meet all the same contracts that you had to meet last year,” Bedke said. “They have to deliver quality products to North Carolina and New York and all around the United States, and they don’t know what they don’t know. But that responsibility has not changed.”

Bedke said that will be a “monumental task” for legislators and those who interact with them when the session begins Jan. 9. But the upside is that new legislators are likely to listen in a way that more seasoned legislators might not have.

“Go create new relationships with the state legislature,” Bedke said. “We need to all be in the long game.”

Gov. Brad Little also spoke at the conference and touted Idaho’s accomplishments with a record surplus and recent funding increases for education, saying Idaho’s economy has weathered the COVID pandemic over the past two years in ways many other states have not.

Business executive: We’ll pay more taxes if needed to support education

Robert Spendlove, chief economist of Zions Bank, spoke about the uncertainty of the economy, which is open to speculation in terms of whether it will fall into a recession or slowly come down from inflation without a recession. A chief economist with the Kem C. Gardner Policy Institute, Phil Dean, said he does not believe the country is anywhere near a recession and it will be important for governments to not react to economic news in a knee-jerk fashion.

“It takes a lot of discipline to create a strategic plan, to really think about what we’re trying to accomplish and move that way,” Dean said. “We need to think broadly across the U.S., how do we build redundancy and resiliency into our systems?”

Two panels of local business executives and public officials also spoke about issues related to Idaho policy, including Ball Ventures President and CEO Cortney Liddiard and Red Sky PR president and CEO Jess Flynn. Flynn said as a small business owner with nine employees, she hopes to see Idaho focus on options for small businesses to provide better health care options, family leave and child care to retain employees.

Liddiard added that Idaho needs to invest in infrastructure like public schools, which have a backlog of deferred maintenance of nearly $874 million, according to a recent Office of Performance Evaluations report.

Liddiard said recent income tax cuts passed by the governor and the Idaho Legislature come with a cost.

“We need to be creative, then, in how do we fund some of these things?” he said, referring to investments in affordable housing and health care on a statewide basis. “I understand you all want to get re-elected, and I understand to give money back and refunds feels good, but we’re behind in so many areas. … I’d love to do whatever I can do, invest whatever resources that Ball Ventures can afford. We’re OK paying a little more tax, frankly. I know it’s not popular, but that funding has to come from somewhere to solve these problems.”

Property tax relief could happen if officials work together, Idaho association director says

One of the last panels discussed property taxes in Idaho, which has given residents heartburn in recent months as assessment notices showed large increases in the value of homes as the market has soared to record highs. Although property tax is often a target for relief by legislators, little has been accomplished in the past several legislative sessions to provide significant property tax reductions.

Kelley Packer, executive director of the Association of Idaho Cities, said cities often receive the blame for rising property taxes, but the levies are driven by growth and the services that are required to maintain the amenities that come with living in a city. Packer said in the legislative session earlier this year, individuals in leadership positions at the Legislature made comments about local officials not bringing any solutions to the table on property tax.

“And I said, ‘Well that’s not true, they’re bringing solutions, they’re maybe just ones that you don’t like,’” Packer said. “There are actual solutions that we could find together rather than just pointing fingers at each other and not getting anything done.”